Health Insurance in India – Complete Beginner Guide

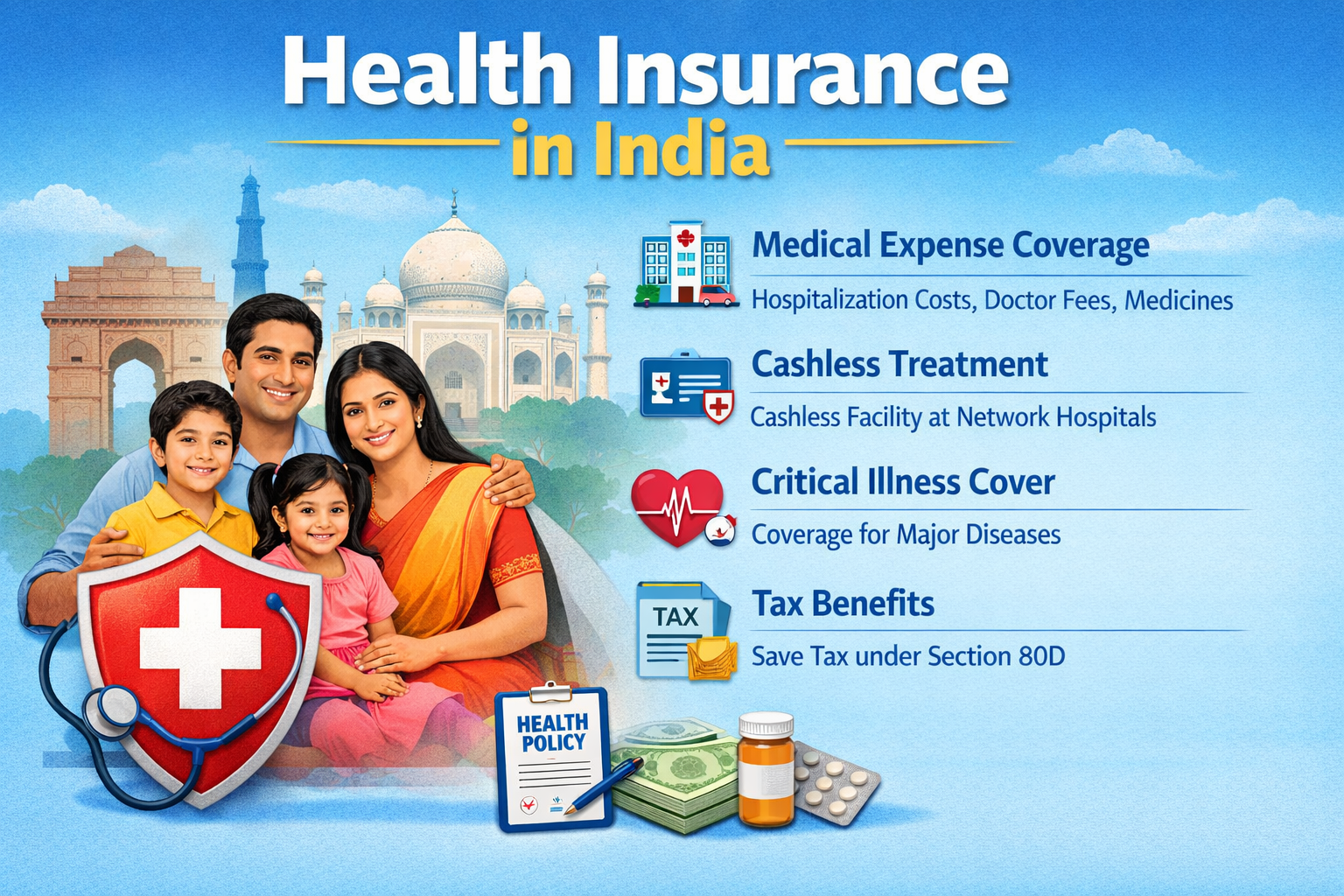

Health Insurance in India ek aisi policy hoti hai jo aapke medical expenses ko cover karti hai jab aap hospital me admit hote ho ya kisi serious treatment ki zarurat hoti hai. Aaj ke time me medical costs bahut tezi se badh rahe hain, aur bina insurance ke ek medical emergency aapki saari savings khatam kar sakti hai.

- Health Insurance in India – Complete Beginner Guide

- Health Insurance Me Kya-Kya Cover Hota Hai?

- Hospitalisation & Day-Care Procedures

- Types of Health Insurance in India

- Health Insurance Me Sum Insured Kitna Hona Chahiye?

- Cashless vs Reimbursement Claim

- Waiting Period Kya Hota Hai?

- Health Insurance Lete Time Common Mistakes

- Best Health Insurance Kaise Choose Kare?

- Frequently Asked Questions

- Trusted Government Resources

- Final Verdict

Isi wajah se health insurance lena ab luxury nahi balki zaroorat ban chuki hai. Is article me hum simple Hinglish me samjhenge ki health insurance kya hota hai, kya-kya cover hota hai, kaunse types hote hain aur kaise best policy choose karein. Hospitalisation expenses (24 hours se zyada)

Health Insurance Me Kya-Kya Cover Hota Hai?

Most health insurance plans India me neeche diye gaye expenses cover karte hain:

1. Hospitalisation expenses (24 hours se zyada)

2. Surgery aur operation charges

3. Doctor consultation fees

4. Medicines aur diagnostic tests

5. ICU aur room rent (policy limit ke andar)

6. Ambulance charges

7. Pre-hospitalisation expenses

8. Post-hospitalisation expenses

Coverage insurer aur plan ke hisaab se thoda vary kar sakta hai, isliye policy document padhna bahut zaroori hota hai.

Hospitalisation & Day-Care Procedures

Health insurance sirf long hospital stay tak limited nahi hota. Aaj kal kai day-care procedures bhi cover hote hain, jaise:

-

Cataract surgery

-

Dialysis

-

Chemotherapy

-

Angiography

Iske alawa:

-

Pre-hospitalisation: 30–60 din tak ke kharche

-

Post-hospitalisation: 60–90 din tak ke kharche

Types of Health Insurance in India

1. Individual Health Insurance in India

-

Sirf ek person ke liye cover

-

Young professionals aur single earners ke liye best

-

Alag se sum insured milta hai

2. Family Floater Health Insurance in India

-

Ek hi policy me poori family covered

-

Spouse, children aur parents include ho sakte hain

-

Individual plans ke comparison me zyada cost-effective

Related guide: /family-health-insurance

3. Senior Citizen Health Insurance in India

-

60 saal ya usse zyada age walon ke liye

-

Premium thoda zyada hota hai

-

Pre-existing disease cover bahut important hota hai

4. Critical Illness Health Insurance in India

-

Cancer, heart attack, stroke jaise serious diseases

-

Ek baar me lump-sum payout

-

Treatment ke saath income loss me bhi help karta hai

Health Insurance Me Sum Insured Kitna Hona Chahiye?

Sahi sum insured choose karna bahut zaroori hai. Ye depend karta hai:

-

Aap metro ya non-metro city me rehte ho

-

Family members ki sankhya

-

Age aur medical history

Recommended Health Insurance Cover

-

Individual: ₹5–10 lakh

-

Family: ₹10–20 lakh

Metro cities me rehne walon ke liye higher cover lena zyada safe hota hai.

Cashless vs Reimbursement Claim

| Claim Type | Meaning |

|---|---|

| Cashless Claim | Hospital ka bill directly insurance company pay karti hai |

| Reimbursement Claim | Pehle aap pay karte ho, baad me insurer se claim milta hai |

Claim process samjhein: /health-insurance-claim-process

Waiting Period Kya Hota Hai?

Health insurance me har disease turant cover nahi hoti. Isse waiting period kehte hain.

Common Waiting Periods

-

Pre-existing diseases: 2–4 saal

-

Maternity cover: 2–4 saal

-

Specific illnesses: 1–2 saal

Isliye early age me policy lena hamesha better hota hai.

Health Insurance Lete Time Common Mistakes

-

Sirf low premium dekhna

-

Kam sum insured lena

-

Waiting period ignore karna

-

Claim process na samajhna

-

Policy document na padhna

Best Health Insurance Kaise Choose Kare?

Sahi decision ke liye ye points dhyaan me rakhein:

-

✔ Network hospitals ki list check karein

-

✔ Claim settlement ratio dekhein

-

✔ Lifetime renewability available ho

-

✔ No-claim bonus ka benefit mile

-

✔ Policy wording dhyaan se padhein

Frequently Asked Questions

Health Insurance in India kyun zaroori hai?

Medical expenses ka burden kam karne aur emergency me financial protection ke liye.

Best health insurance cover kitna hona chahiye?

Individual ke liye ₹5–10 lakh aur family ke liye ₹10–20 lakh recommended hai.

Cashless claim kaise kaam karta hai?

Network hospital me bina payment kiye treatment milta hai, bill insurer pay karta hai.

Waiting period kya hota hai?

Kuch diseases ke liye claim karne se pehle ka time period.

Senior citizens ke liye alag plan hota hai?

Haan, senior citizen specific plans available hote hain.

Employer health insurance kaafi hai?

Mostly nahi, personal health insurance lena safer option hota hai.

Trusted Government Resources

-

IRDAI Official Website: https://www.irdai.gov.in

-

Ministry of Health: https://www.mohfw.gov.in

Final Verdict

Health Insurance in India koi extra kharcha nahi balki ek smart financial planning tool hai. Agar aap sahi age par, sahi coverage aur sahi policy ke saath insurance lete ho, to medical emergencies me bina stress ke best treatment le sakte ho.